does michigan have a inheritance tax

Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. Only a handful of states still impose inheritance taxes.

Michigan Inheritance Laws What You Should Know

The state repealed those taxes in 2019 and so it leaves families or survivors of individuals without those.

. An inheritance tax return must be filed for the estates of any person who died before October 1 1993. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Michigan does have an inheritance tax.

Michigan does not have an inheritance tax or estate tax on a decedents assets. Died on or before September 30 1993. If you have to pay.

The State of Michigan does not. Both inheritance and estate taxes are called death taxes. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost.

Estate tax is paid by the estate and before any inheritances are passed to beneficiaries. Inheritance tax is levied by state law on an heirs right to receive property from an estate. Is there still an Inheritance Tax.

No Comments on does michigan have inheritance tax Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and. Michigans estate tax is not operative as a result of changes in federal law. According to the michigan department of treasury if a beneficiary inherits assets from a loved one who.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Its applied to an estate if the deceased passed on or before Sept. There is no federal inheritance tax but there is a federal estate tax.

Michigan does not have an inheritance tax with one notable exception. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. An inheritance tax is a levy.

Michigan does not have an inheritance tax with one notable exception. Twelve states and Washington DC. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who.

Morning 4 Michigan Governor Proposes A Repeal Of Retirement Tax And More Top Stories

Michigan Estate Tax Everything You Need To Know Smartasset

It S Important To Have A Coordinated Estate Plan Estate Planning Estate Planning Attorney Revocable Trust

Michigan Inheritance Laws What You Should Know

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Michigan Estate Tax Everything You Need To Know Smartasset

Federal And Michigan Estate Tax Amounts On Inheritances

Mi Mitten Map Of Michigan Detroit Michigan Michigan Road Trip

Oktodie Com How To Plan Loving Someone Resources

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Laws What You Should Know

Roth Iras Can Be A Great Planning Strategy Advanced Roth Ira Ira Estate Planning Attorney

Michigan Health Legal And End Of Life Resources Everplans

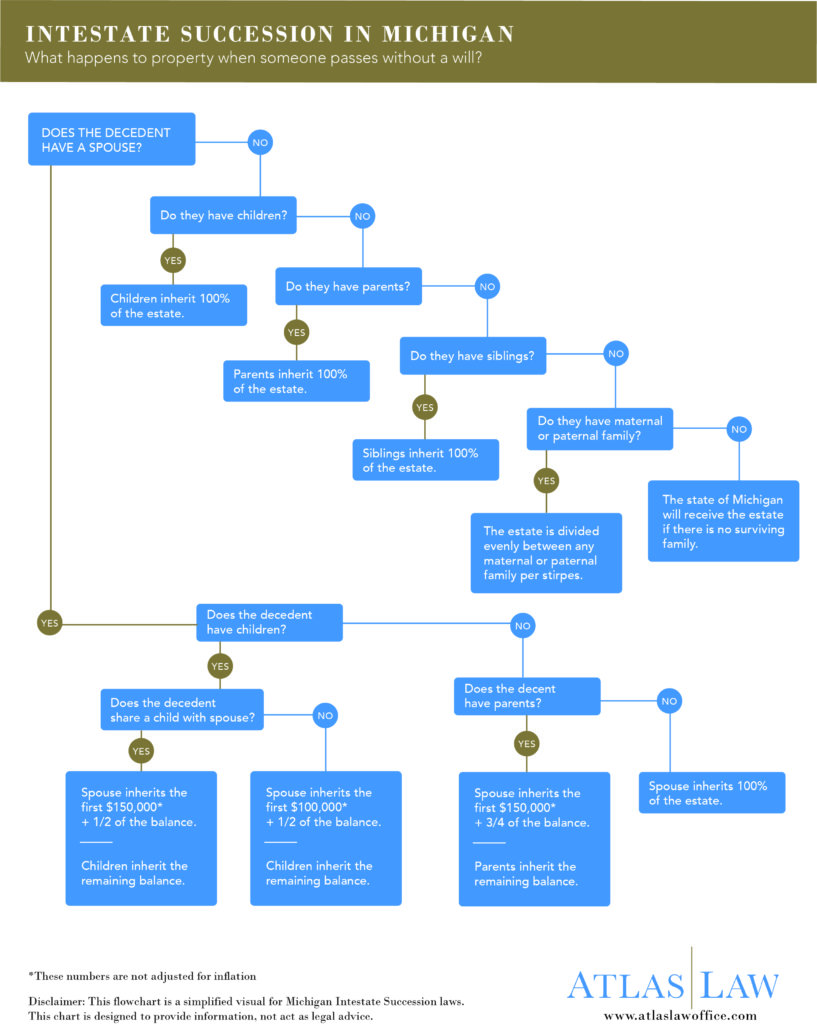

Michigan Rules Of Intestate Succession Atlas Law

Michigan Inheritance Tax Explained Rochester Law Center

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc